Sers Payment Calendar 2026 Unbelievable

Sers Payment Calendar 2026 Unbelievable. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Also know interest and penalty charges for late deposit or filing of tds return.

Know about time limit to deposit tds and file tds return. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Also know interest and penalty charges for late deposit or filing of tds return.

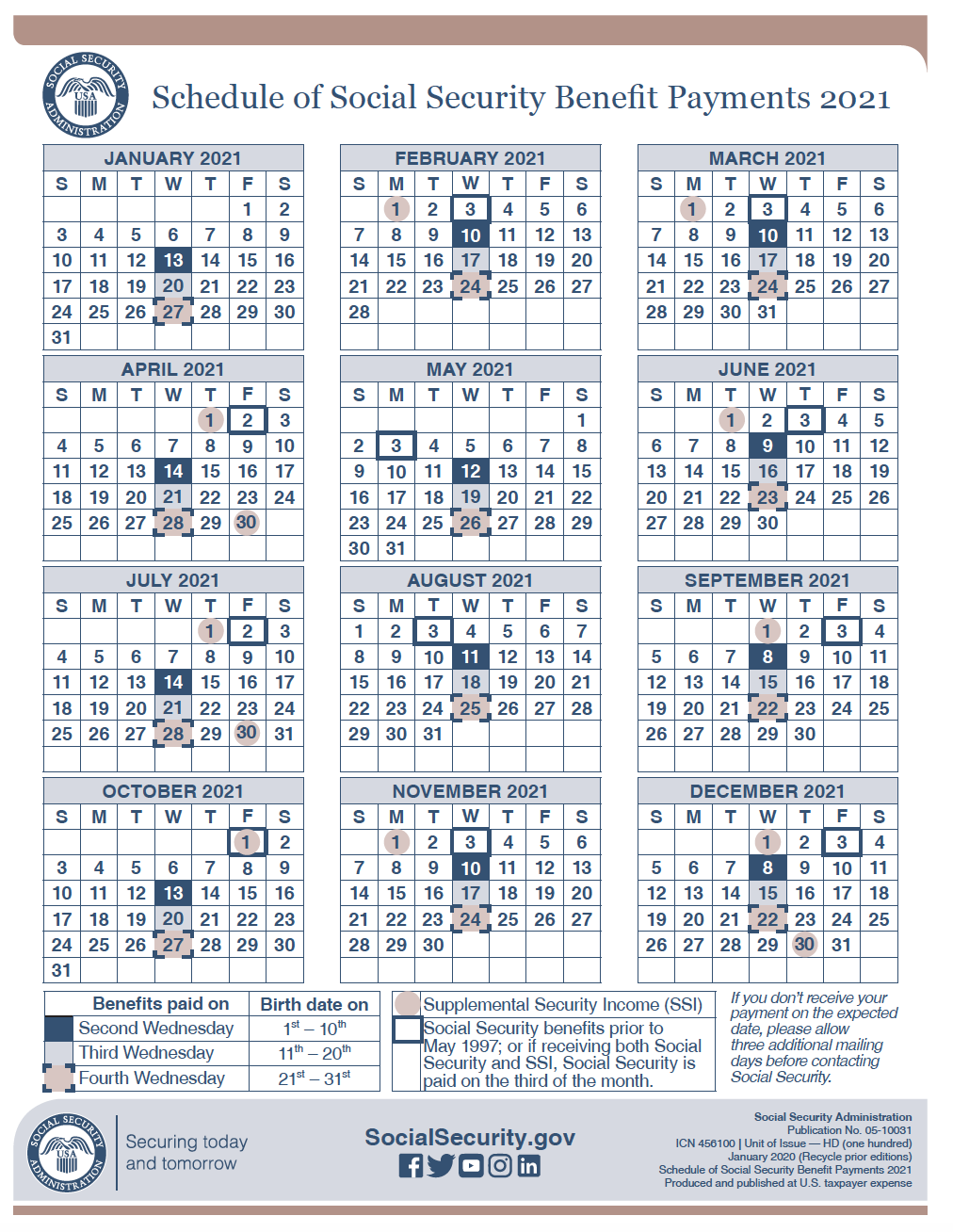

Source: robinrlewisr.pages.dev

Source: robinrlewisr.pages.dev

Social Security Calendar Payments For 2025 Robin R Lewis Also know interest and penalty charges for late deposit or filing of tds return. We are happy to share a comprehensive compliance calendar for private companies, small companies, not for profit covering secretarial, fema compliances, threshold compliances and many more!

Source: member.railwayspensions.co.uk

Source: member.railwayspensions.co.uk

My pension payments and P60s Railways Pension Scheme Tax deducted at source (tds) is a key component of india’s income tax framework, designed to collect tax revenue at the time. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

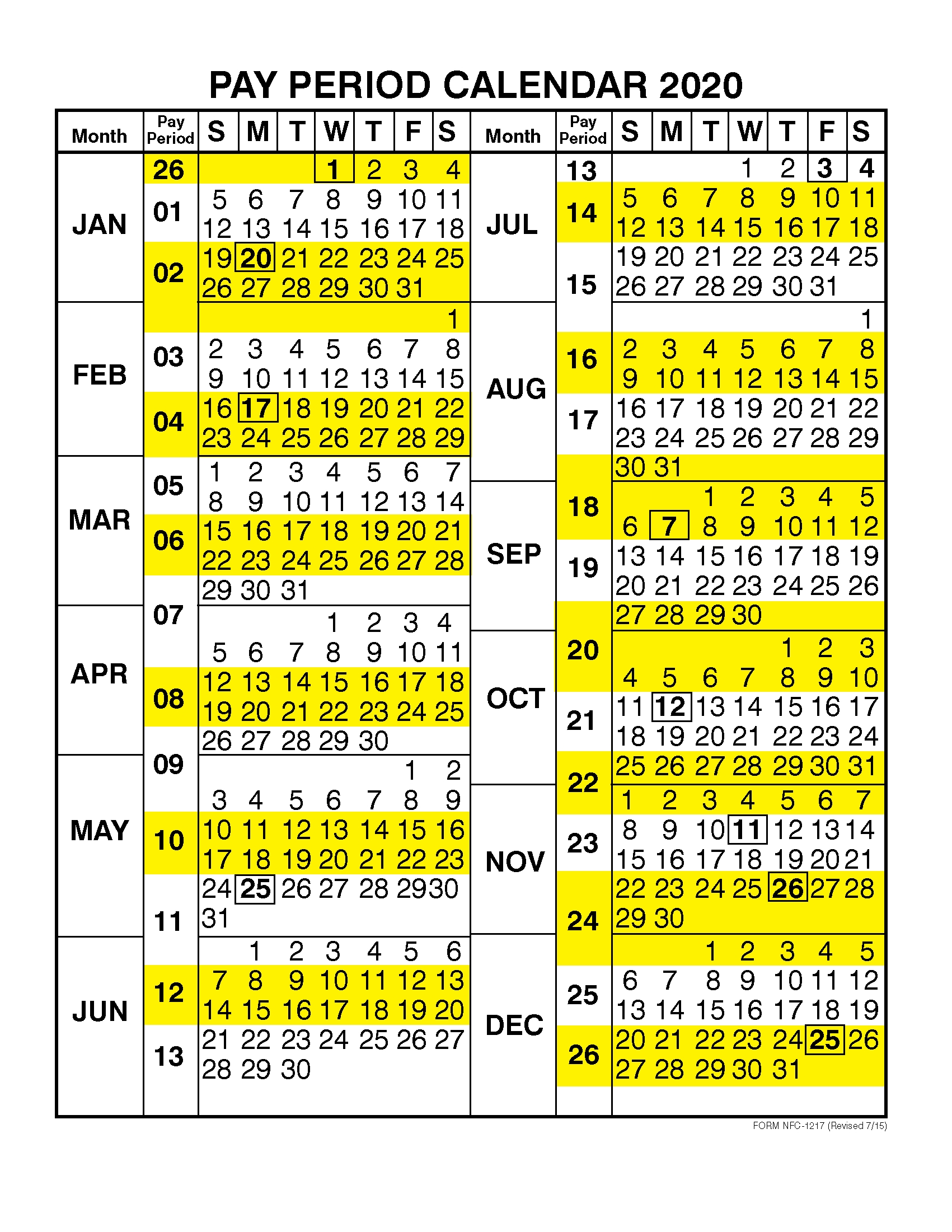

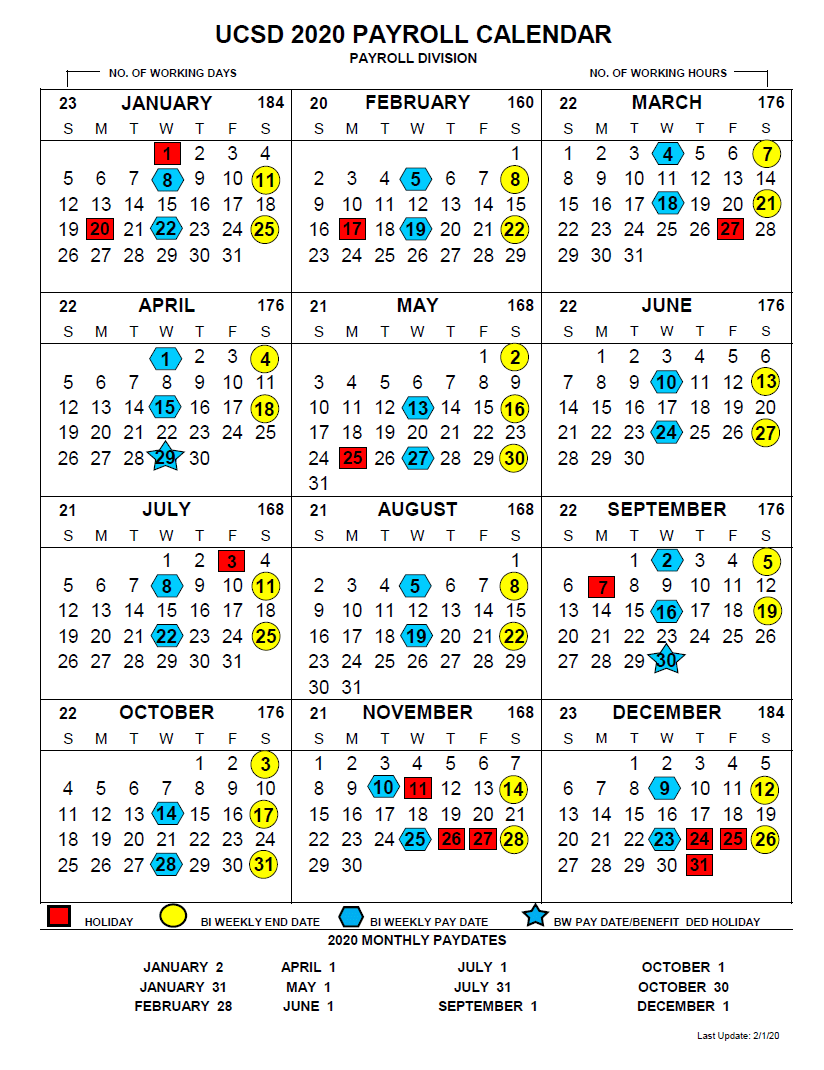

Source: antoniabvega.pages.dev

Source: antoniabvega.pages.dev

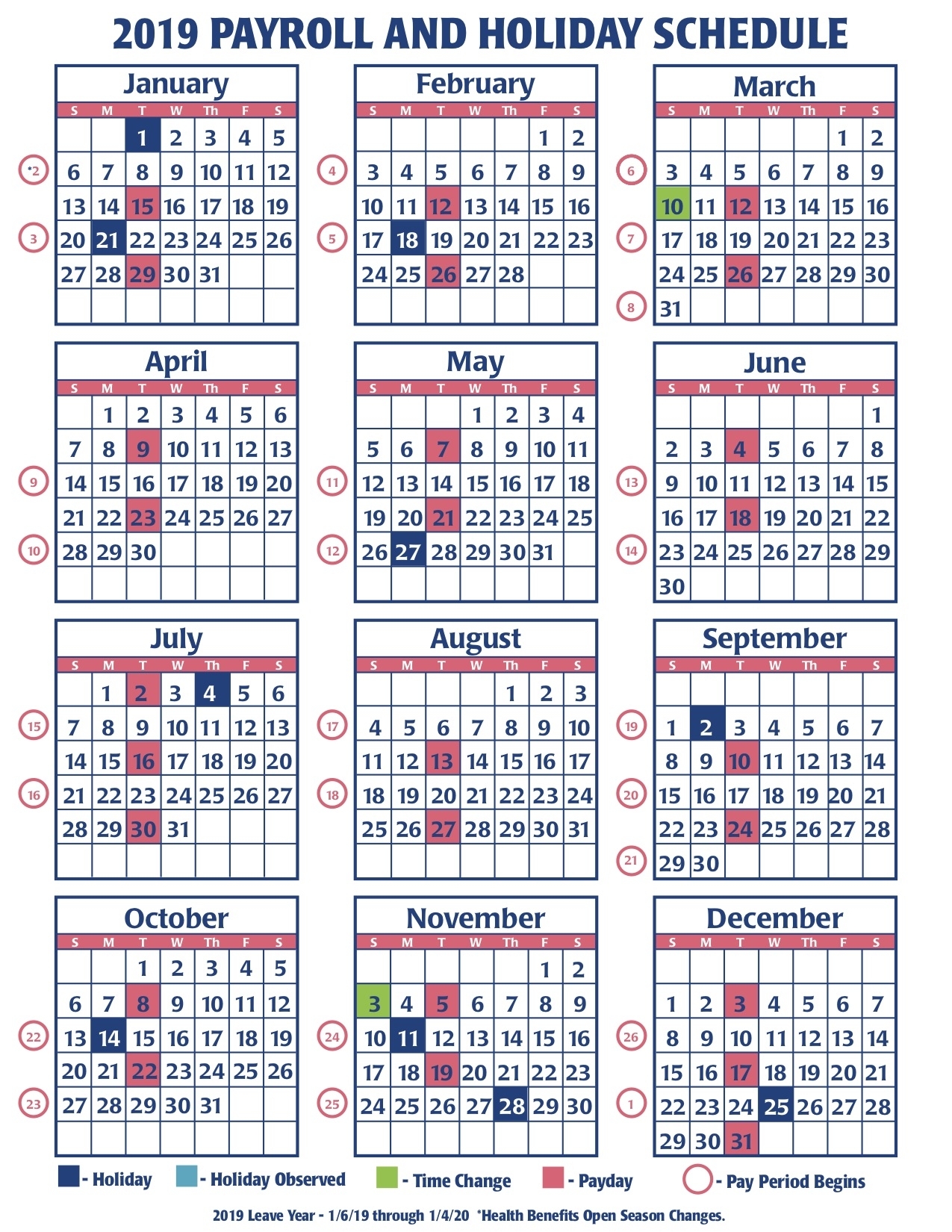

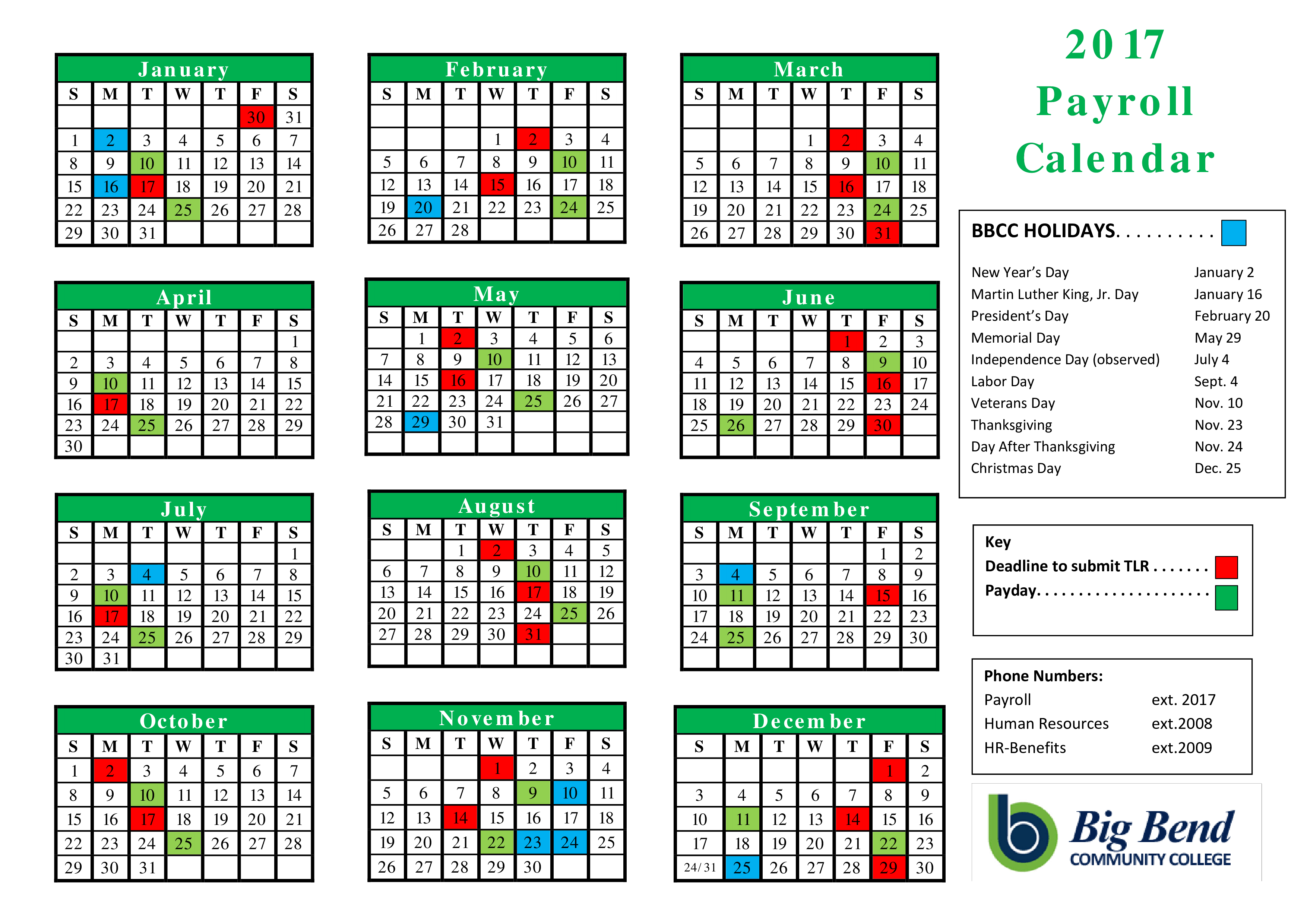

Navigating The Federal Pay Calendar A Comprehensive Guide To A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Know about time limit to deposit tds and file tds return.

Source: antoniabvega.pages.dev

Source: antoniabvega.pages.dev

Navigating The Federal Pay Calendar A Comprehensive Guide To Tax deducted at source (tds) is a key component of india’s income tax framework, designed to collect tax revenue at the time. Also know interest and penalty charges for late deposit or filing of tds return.

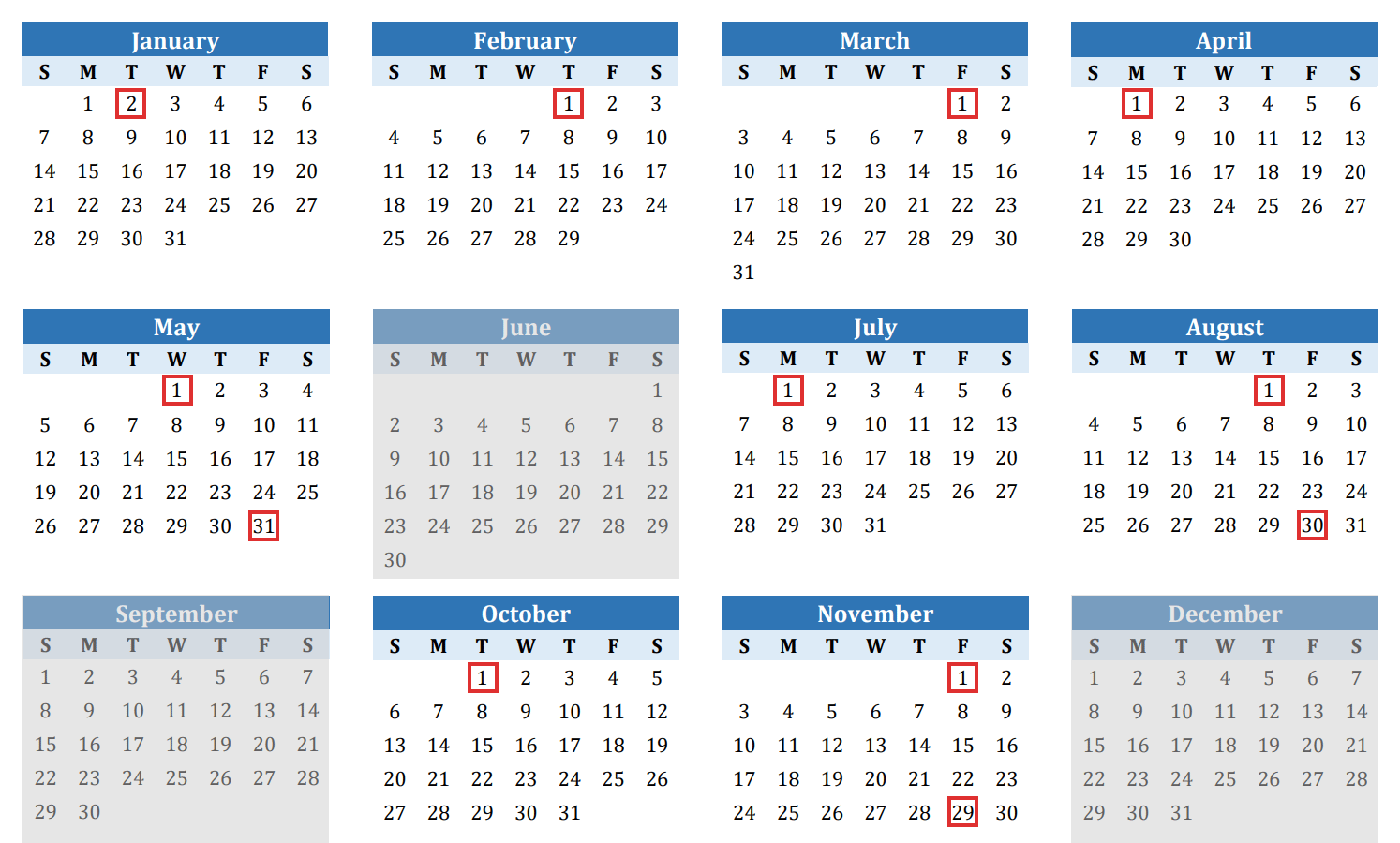

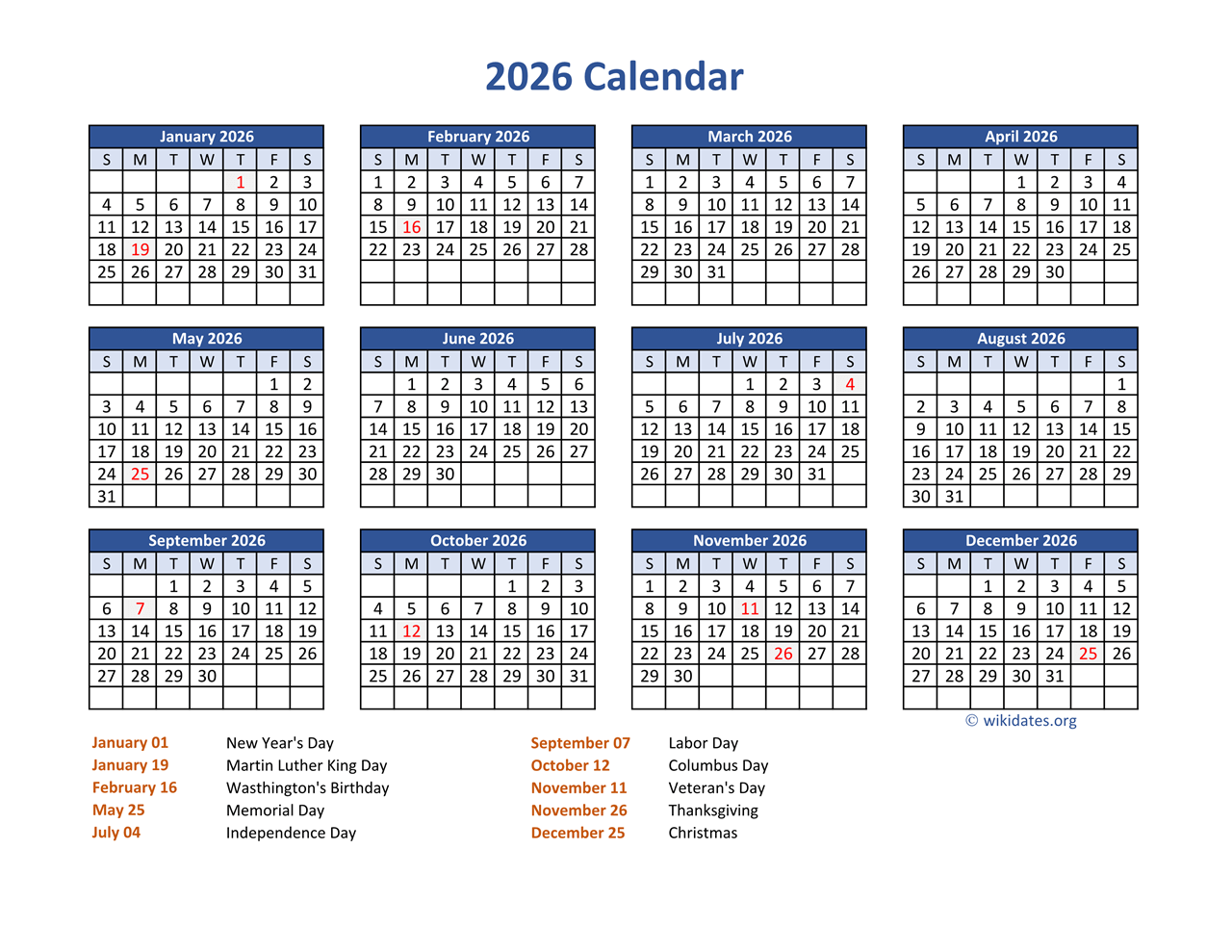

Source: calendar.weloveprintables.net

Source: calendar.weloveprintables.net

2026 BiWeekly Pay Calendar Free Printable Calendar We are happy to share a comprehensive compliance calendar for private companies, small companies, not for profit covering secretarial, fema compliances, threshold compliances and many more! Know about time limit to deposit tds and file tds return.

Source: jameslyul.pages.dev

Source: jameslyul.pages.dev

Social Security 2025 Payment Calendar James L Yu We are happy to share a comprehensive compliance calendar for private companies, small companies, not for profit covering secretarial, fema compliances, threshold compliances and many more! Also know interest and penalty charges for late deposit or filing of tds return.

Source: agneshjkkeelia.pages.dev

Source: agneshjkkeelia.pages.dev

Gs Pay Calendar 2026 Allys Ofella We are happy to share a comprehensive compliance calendar for private companies, small companies, not for profit covering secretarial, fema compliances, threshold compliances and many more! Tax deducted at source (tds) is a key component of india’s income tax framework, designed to collect tax revenue at the time.

Source: agneshjkkeelia.pages.dev

Source: agneshjkkeelia.pages.dev

Gs Pay Calendar 2026 Allys Ofella Also know interest and penalty charges for late deposit or filing of tds return. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

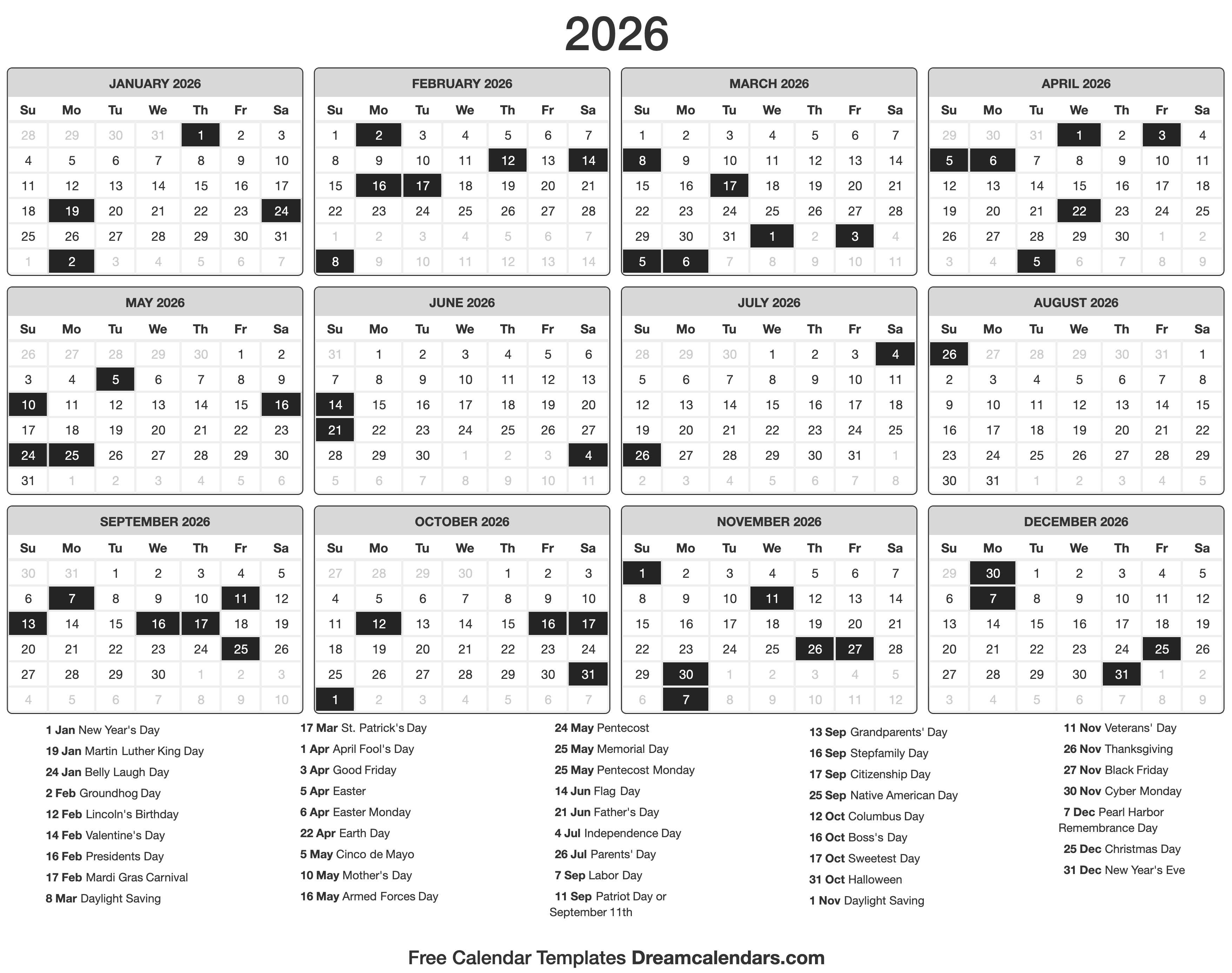

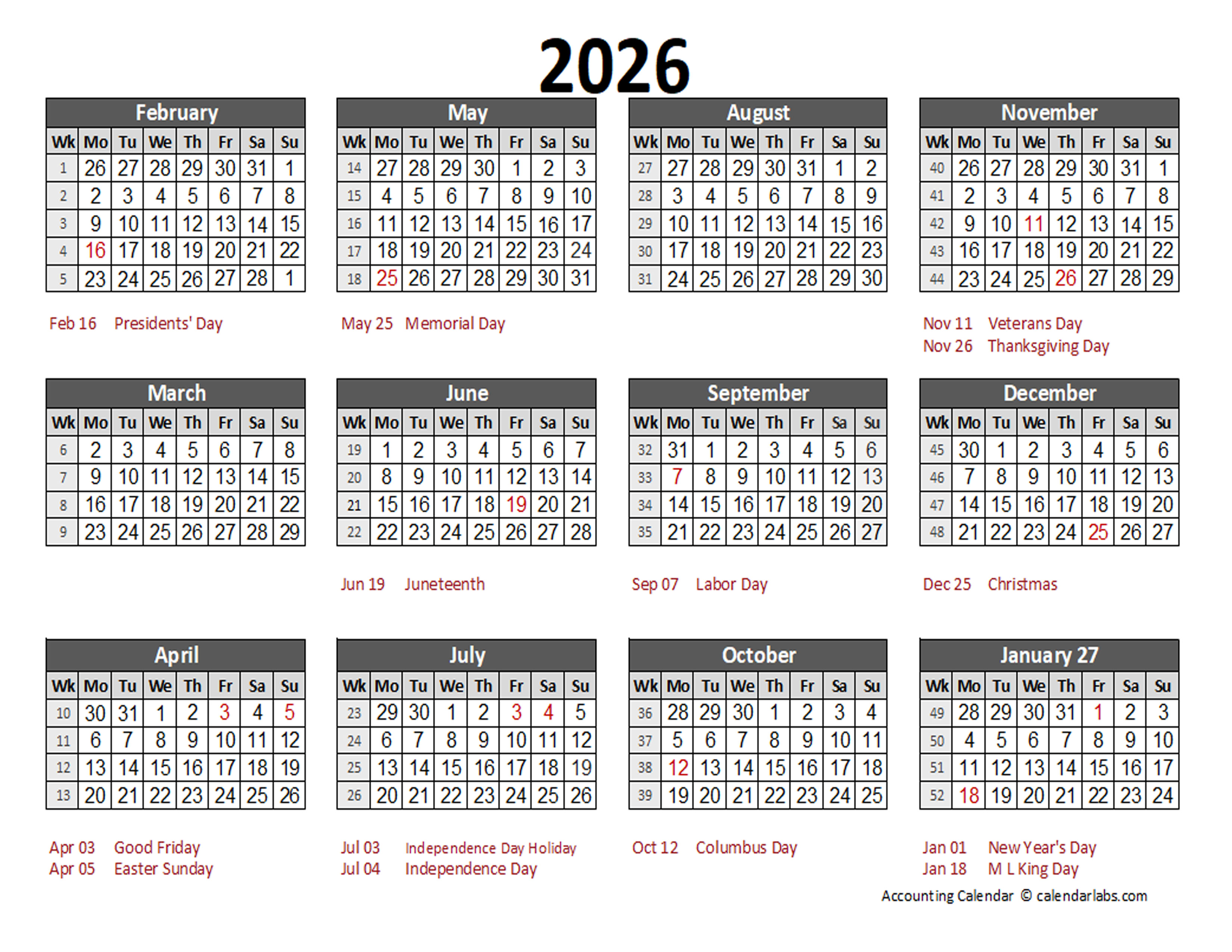

Source: www.calendarlabs.com

Source: www.calendarlabs.com

2026 Accounting Calendar 544 Free Printable Templates Also know interest and penalty charges for late deposit or filing of tds return. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

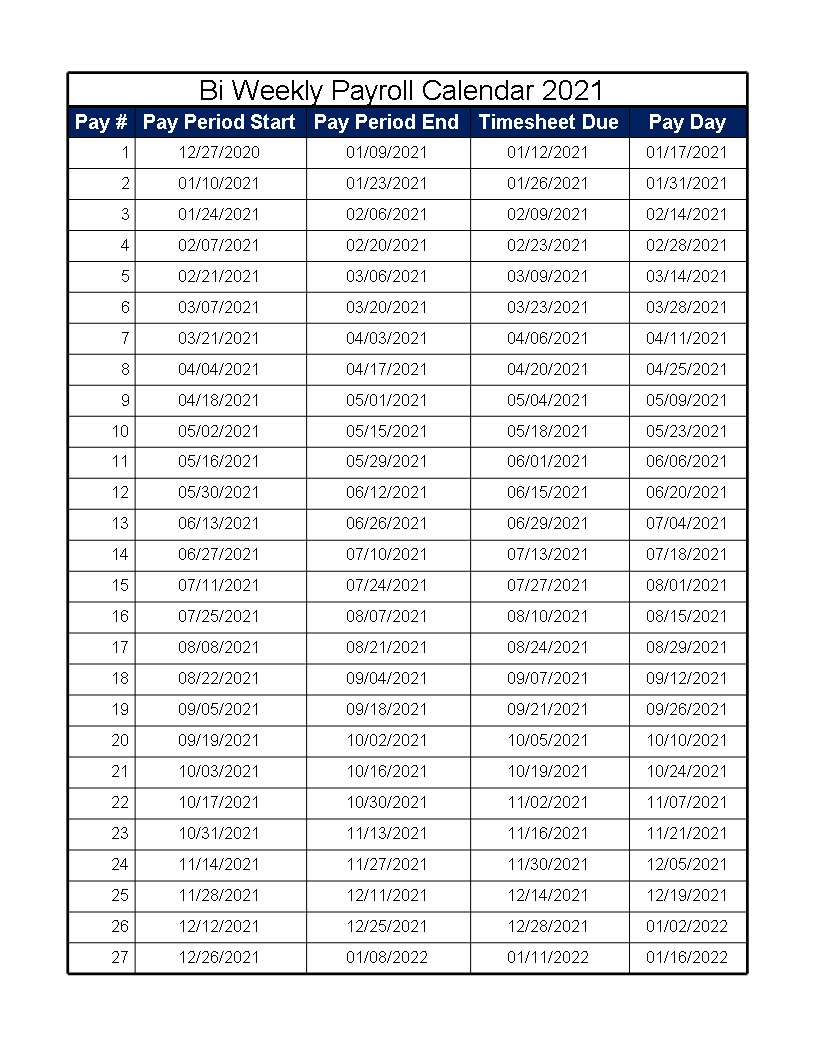

Source: oliveraparkes.pages.dev

Source: oliveraparkes.pages.dev

Navigating The Future A Comprehensive Guide To The 2026 OPM Pay Plan We are happy to share a comprehensive compliance calendar for private companies, small companies, not for profit covering secretarial, fema compliances, threshold compliances and many more! Know about time limit to deposit tds and file tds return.

Source: antoniabvega.pages.dev

Source: antoniabvega.pages.dev

Navigating The Federal Pay Calendar A Comprehensive Guide To A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Know about time limit to deposit tds and file tds return.

Source: jayjwebsterj.pages.dev

Source: jayjwebsterj.pages.dev

Bcps Payroll Calendar 2025 26 Jay J. Webster Tax deducted at source (tds) is a key component of india’s income tax framework, designed to collect tax revenue at the time. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.